1. New

Last update : November 2025

Rate of Profit, Rate of Surplus Value, Organic Composition of Capital and their Determinants, USA. Four graphs below, from 1929 until 2024 :

Value and productive labour. A purely social approach to some basic concepts of Marxist economic theory, Louvain-la-Neuve, Diffusion Universitaire Ciaco, 2019, 60 pages : see section 6.

250 years of Capitalism §01&02 and its dynamics Rate of Surplus Value, Rate of Profit, Real Wages...

- Rate of Profit and Periodic Crises - United States 1929-2024

- Rate of Profit - Rate of Surplus Value - Organic Composition of Capital, United States 1929-2024

- Rate of Surplus Value and its Determinants, United States 1929-2024

- Organic Composition of Capital and its Determinants, United States 1929-2024

- Real Wages and Productivity, United States 1948-2021

- The methodological framework of Marx’s theory of crises and its empirical validation

Rate of Profit and Periodic Crises - United States 1929-2024

![[Gb] - EU 1929-2024 - Taux de profit et Crises cycliques](/telechargements/images/large_[Gb]_EU_1929_2024_Taux_de_profit_et_Crises_cycliques.png)

Note for the reading of our graphs : All our indicators have been transformed into indices (1929 = 100). An index of 166 in 1966 for the profit rate means that it was 66% higher than in 1929, while an index of 68 in 1938 means that it was 32% lower. The shaded bars are only there to indicate the years of economic crisis officially recognised as such by the NBER, so their height has no particular significance. The NBER refers to a recession as « a significant decline in economic activity across all sectors over several months, normally visible in output, employment, real income and other indicators ».

Profit rates and cyclical crises

Profit is the goal and the driving force of all investment in the capitalist economy : a capital owner will only invest if he expects to earn a sufficient amount and rate of return : "The rate of profit is the driving force of capitalist production, and only what can be produced at a profit is produced... [...] ...the rate of development of total capital, the rate of profit, is indeed the spur of capitalist production (just as the development of capital is its sole end)..." [1]. It measures, as it were, the final profitability of the capitalist economy since it relates the profit obtained to the investment made. Marx calculates it by reducing the surplus value obtained to the total capital invested [2]. When the rate of profit is rising (green arrows up in the graph above), business flourishes, when it is falling (red arrows down), it contracts, and when it reaches the lowest point of a boom and bust cycle (red circles), a crisis breaks out (vertical grey lines).

The consequences of the crisis will be to harden the conditions of exploitation of workers and to depreciate all the elements involved in productive activity: wages decrease as a result of rising unemployment and 'machine capital' (or constant capital) devalues as a result of bankruptcies, unsold goods or liquidations. In other words, by increasing the numerator of the rate of profit (the surplus value resulting from the exploitation of wage earners) and by decreasing its denominator (devaluation of machines and a fall in wages), the crisis allows it to recover. A new cycle of production can then be restarted until the next crisis and so on : "The stagnation which has occurred in production would have prepared - within capitalist limits - a subsequent expansion of production. Thus the cycle would have been run through once more. A part of the capital depreciated by stagnation would regain its former value. Moreover, the same vicious circle would again be followed, under amplified production conditions, with an enlarged market, and with an increased productive potential" [3]. The internal mechanism of the crisis thus creates, by itself, the conditions for an "enlarged market", an "increased productive potential" and an "amplified production".

This is exactly what the graph above shows us, where each crisis comes after a cycle of rising and falling profit rates. The exception of the crisis in 1945 can be explained by the difficulties in reconverting the American economy just after the end of the war [4]. Thus, the downward turn in the rate of profit since 2013 heralds the next economic crisis, which the pandemic accelerated in 2020. This self-sustaining breathing of productive activity, interspersed with periodic crises, is one of the most beautiful confirmations of the analysis that Marx drew from his empirical observations and theoretical work. Engels summarises it in the Anti-Dühring [5]:

"...since 1825, when the first general crisis broke out, the entire industrial and commercial world, the production and exchange of all civilised peoples and their more or less barbaric satellites, has gone haywire about once every ten years. Trade comes to a standstill, markets are clogged, products are there in quantities as massive as they are unsaleable, cash becomes invisible, credit disappears, factories stop, the working masses lack the means of subsistence for having produced too many means of subsistence, bankruptcy follows bankruptcy, forced sale follows forced sale. The bottleneck lasts for years, productive forces and products are squandered and destroyed en masse until the masses of accumulated goods finally run off with a more or less strong depreciation, until production and exchange gradually resume their march. Gradually, the pace quickens, becomes a trot, the industrial trot becomes a gallop, and this gallop in turn increases until the belly to the ground of a complete steeple chase of industry, trade, credit and speculation, to end up, after the most perilous jumps, in the ditch of the crash... And always the same repetition. This is what we have experienced no less than five times since 1825, and what we are experiencing at this moment (1877) for the sixth time" [6].

The relevance of this analysis is not only attested to by all the cyclical crises that have occurred since 1929, as shown in our graph above, but more globally by the twenty-five crises that capitalism has experienced over the last two centuries [7] if we consider 1825 as the first general crisis of capitalism : "...it is only with the crisis of 1825 that the periodic cycle of the modern life of capitalism opens" [8]. This gives us an average cycle of more or less eight years between two crises at international level over two centuries, and six and a half years for the period considered here (1929-2024).

The cyclical character of the accumulation of capital and its crises over the last two centuries, as well as the perfect correspondence between the evolution of the rate of profit and the outbreak of crises, should, to say the least, be puzzling to those who still claim to be part of the Luxemburgist analysis, which affirms, in spite of such evidence, that : "the formula of a decennial period fulfilling the whole cycle of capitalist industry was, for Marx and Engels in the 1860's and 70's, a simple statement of fact : these facts did not correspond to a natural law, but to a series of determined historical circumstances... [...] The decennial periodicity of these international crises is a purely external fact, a chance" [9]. That in two centuries of capitalism there have been twenty-five international crises so closely correlated to the evolution of the rate of profit is not "a purely external fact, a coincidence", especially since this correlation corresponds in every respect to the analysis outlined by Marx in Capital.

___________________________________________________________

[1] Marx, Capital, Book III, Ed. Sociales, volume 1: 271, 254.

[2] In everyday language: profit / total capital = profit / (wages + machine capital) or, in Marxist terms: surplus value / (variable capital + constant capital).

[3] Marx, La Pléiade - Economie II, book III of Capital: 1037.

[4] We have chosen the example of the United States because, despite its loss of power from the 1970s onwards, this country has remained the dominant economy for more than a century and, as such, is often the trigger for crises on an international scale (think of the 1929 crisis or the subprime crisis in 2008-09). Thus, an international economic crisis inevitably affects the United States and a crisis in this country de facto affects the world economy. With the exception of emerging Asia, which we will only mention and which unfortunately we cannot dwell on here, the developments described in this contribution are valid for most of the developed world economy.

[5] This work, signed by Engels, was in fact conceived, discussed and co-written with Marx : "...the foundations and development of the conceptions set forth in this book being due in the main to Marx, and to me only in the smallest measure, it was self-evident between us that my exposition should not be written without his knowledge. I read the whole manuscript to him before printing and it was he who, in the section on the economy, wrote the tenth chapter...", Engels' preface to the second edition, Ed. Sociales 1973: 38.

[6] Chapter II, Theoretical Concepts, Ed. Sociales 1973: 312-313.

[7] 1825, 1836-39, 1847-48, 1857, 1864-66, 1873, 1882-84, 1890-93, 1900-03, 1907, 1911-13, 1918-21 (23 in All), 1929-32, 1937-38, 1948-49, 1952-54, 1957-58, 1966-67, 1970-71, 1974-75, 1980-82, 1990-91, 2001, 2008-09, 2020.

[8] Marx, The Pleiades, Economics I, Afterword to the second German edition of Capital : 553.

[9] Rosa Luxemburg, Reform or Revolution (1898), Maspéro.

.

Top of pageRate of Profit - Rate of Surplus Value - Organic Composition of Capital, United States 1929-2024

![[Gb] - EU 1929-2024 - Taux de profit - Taux de plus-value - Composition du capital](/telechargements/images/large_[Gb]_EU_1929_2024_Taux_de_profit_Taux_de_plus_value_Composition_du_capital.png)

Note for the reader: For ease of reading, the grey bars indicating moments of economic crisis only go up to the lowest curve to avoid overlaps.

The profit rate measures the return on total capital invested. It shows how this capital is put to use, and thus expresses the degree to which the capitalist goal has been achieved. Of all the laws of capitalism, it is the one that Marx considered to be historically the most important [1]. Its fluctuations reflect two dynamics:

1) On the one hand, the short-term pulsations of the cycles of accumulation, composed successively of a period of rise in the rate of profit, then a fall, and ending with a recession. These are the economic cycles typically studied by Marx in Capital [2], cycles he called ‘decennial’ [3], and which are essentially determined by variations in the rate of surplus-value.

2) On the other hand, there are the medium-term trends in the rate of profit, which can be broken down into larger phases: upwards (1933-44), stable (1944-66), downwards (1966-82), upwards (1982-97), and a more moderate increase since 1997. These medium-term phases are essentially determined by changes in the organic composition (in value) of capital: (1933-44), (1944-66), (1966-82), (1982-2000) and (2000...).

However, just because the rate of profit falls at the end of each accumulation cycle does not necessarily mean that there is a downward trend in the rate of profit, just as just because global warming and the summer season correspond to a rise in temperature does not mean that these two phenomena share the same causality: the first is linked to human activities, and the second to the rotation of the earth around the sun. The same applies to the profit rate: neither its short- or medium-term fluctuations nor the reasons for these fluctuations should be confused. Thus, the recurrent falls in the rate of profit at the end of accumulation cycles can take place within a medium-term upward or downward trend in the rate of profit. It is in the medium term that the downward trend operates, as Marx pointed out in Capital, and not in each short cycle [4].

Fluctuations in the rate of profit result from the respective evolution of the rate of surplus-value in the numerator and the organic composition of capital in the denominator:

- The rate of surplus value divides the social product between profits and wages. The dynamics of investment and crises therefore depend to a great extent on the balance in the proportionality of this distribution, as Marx explains in Book II of Capital: « ...the consumer power of society. ...but by the consumer power based on antagonistic conditions of distribution, which reduce the consumption of the bulk of society to a minimum varying within more or less narrow limits. It is furthermore restricted by the tendency to accumulate, the drive to expand capital and produce surplus-value on an extended scale » [5].

- The organic composition of capital measures the increase in the value of constand capital when productivity gains in this sector can no longer compensate for spending on an increased number of means of production.

The graph shows that the rate of profit and the rate of surplus-value move very closely together, with the organic composition of capital adding to or counteracting their effects: in both downturns and upturns, the rate of profit turns around first as a result of the inversion of the rate of surplus-value, with the composition of capital only playing its part subsequently.

It should not be forgotten, however, that both the numerator of the rate of profit (the rate of surplus value) and its denominator (the organic composition of capital) are very strongly influenced by changes in labour productivity. The effects of the latter are detailed in the graphs below, which explain the determinants of the rate of surplus-value and the organic composition of capital.

Capitalism needs two legs to stand on: production and sales. Too often, however, the rate of profit is presented as being reduced solely to the difficulties encountered in production (the difficulty of extracting enough surplus labour for a given amount of capital). In reality, the rate of profit is a synthetic variable which expresses both the dynamics and the contradictions relating to the production and realisation of value: as its evolution depends as much on the efficiency of capital (in the denominator) as on the distribution of the total product (the rate of surplus-value in the numerator), it measures both the capacity of capital to ensure its profitability and the adequacy of wage outlets for production. It is therefore wrong to privilege only one of the two aspects of the circuit of accumulation (production or sale), or to make them strictly dependent on each other. In fact, Marx develops an integrated vision of the circuit of accumulation as a system of partially independent variables. This synthetic conception of the rate of profit is one of Marx's major methodological contributions. This is a far cry from the simplistic schemes that reduce the complex mechanics of Capital and its contradictions to a monocausal explanation, in which the recurrent crises are always due to one and the same cause throughout history, be it :

- the contradiction between the social character of production and its private appropriation (Lenin);

- the progressive exhaustion of extra-capitalist markets (Luxemburg);

- the shortage of surplus-value resulting from over-accumulation (Grossman-Mattick);

- the concentration of capital and disproportionalities between sectors I & II (Hilferding);

- unequal exchange (Samir Amin);

- the value form and the transition from the formal to the real subjection of labour by capital (Internationalist Perspective);

- etc.

In conclusion, the rate of profit should be seen as an integrated indicator that reflects both the conditions of production and the realisation of the total social product. It expresses both the contradictions linked to the distribution of the value produced (the class struggle - i.e. the rate of surplus-value in the numerator), and the mechanism for increasing the volume and value of fixed capital (the productive forces - i.e. the organic composition of capital in the denominator).

_______________________________________

The quotations are translated from French, so they do not come from an English edition.

[1] « ...of all the laws of modern political economy, it is the most important. Essential for the understanding of the most difficult problems, it is also the most important law from the historical point of view, a law which, despite its simplicity, has never been understood until now, still less consciously enunciated » Marx, Grundrisse, La Pléiade II: 271-272.

[2] « As accumulation diminishes, so does the cause of its diminution, namely, the disproportion between capital and exploitable labour-power. The mechanism of the capitalist process of production thus eliminates of itself the obstacles which it spontaneously creates for itself » Marx, Le Capital, Livre I, 4ème édition allemande, Editions Sociales, 1983: 694. « Crises are never more than momentary and violent solutions which re-establish for a moment the disturbed equilibrium [...] The stagnation which occurred in production would have prepared - within capitalist limits - a subsequent expansion of production. In this way, the cycle would once again have been completed. Part of the capital depreciated by stagnation would regain its former value. Moreover, the same vicious circle would be repeated, under amplified conditions of production, with an enlarged market, and with increased productive potential » Marx, Le Capital, Livre III, La Pléiade II: 1031 & 1037.

[3] The cycle of accumulation is rooted in the need to increase constant capital at the expense of variable capital; its rhythm is therefore essentially linked to the more or less decennial cycles of rotation of fixed capital: « As the value and duration of the fixed capital employed develop with the capitalist mode of production, the life of industry and of industrial capital develops in each particular enterprise and is prolonged over a period, say ten years on the average. [...] ...this cycle of rotations which follow one another and are prolonged over a series of years, in which capital is a prisoner of its fixed element, constitutes one of the material bases of periodic crises » Marx, Le Capital, Livre II, La Pléiade: 614. Marx uses the ten-year period as an average, not as an absolute: « No doubt the periods of investment of capital are very different, but the crisis always serves as a point of departure for a powerful investment; it therefore more or less provides - from the point of view of society as a whole - a new material basis for the next cycle of rotation » Marx, Le Capital, Livre II, Editions Sociales, tome IV: 171.

[4] « Thus the law [of the tendency of the rate of profit to fall] acts only as a tendency whose action manifests itself clearly only in certain circumstances and over long periods of time » Livre III, La Pléiade II: 1023. Marx thus defines two cases in which ‘the action of the law clearly manifests itself’: (1) « in certain circumstances » and (2) « over long periods of time ». But what does he mean by « long periods »? The answer is clearly given at the beginning of the same chapter on contrary influences: « If we consider the enormous development of the productive forces of social labour, if only in the last thirty years, and if we compare this period with all previous periods; if we consider more particularly the enormous mass of fixed capital which, in addition to machinery proper, enters into the social process of production, taken as a whole, then the difficulty which economists have hitherto encountered is not to explain the fall in the rate of profit as such, but rather the reasons why this fall has not been greater or more rapid » (idem: 1014). So when Marx speaks of « long periods » during which the law of the tendency of the rate of profit to fall applies, he's talking about ‘thirty years’. From then on, we are neither in the temporality of ten-year cycles of accumulation, nor in the secular temporality advanced by certain authors, a temporality absent from Marx's work since he dates the beginning of the modern epoch of capitalism from 1825 and wrote Capital in the second half of the nineteenth century.

[5] Marx, Le Capital, Livre III, La Pléiade II : 1026-1027.

.

Top of pageRate of Surplus Value and its Determinants, United States 1929-2024

![[Gb] - EU 1929-2024 - Taux de plus-value et ses déterminants](/telechargements/images/large_[Gb]_EU_1929_2024_Taux_de_plus_value_et_ses_déterminants.png)

Fluctuations in the rate of surplus value are closely linked to changes in the rate of profit. In the graph, fluctuations in the rate of surplus value (1) are the result of class struggle, i.e. variations between the value created by wage earners (3) and what they cost (4): the rate of surplus value rises when these two curves diverge, and falls when they converge. They can also be deduced from the differential between productivity growth in the consumer goods sector (5) and growth in real wages (2): when productivity gains are greater than the rise in real wages, the rate of surplus value increases, and vice versa (for equal working hours).

I. 1933-1944

After the fall in the rate of surplus value following the 1929 crisis, it recovered until 1944 thanks to the economic recovery driven by the New Deal (1933-39) and then by the war economy during the Second World War.

II. 1946-1966

After the fall in the rate of surplus value following the post-war difficulties, it recovered until 1966. Contrary to popular belief, wages and profits do not necessarily move in opposite directions: they can increase together, provided that productivity gains are sufficiently intense and widespread. This was the ‘miracle’ of the Thirty Glorious Years, during which all the economic variables increased together, while at the same time allowing a reduction in working hours! This resulted in full employment and a tripling of real wages in OECD countries (on average). The graph shows that intense productivity gains during this period:

* lowered the average value of consumer goods (5),

* and therefore the value of labour power (4),

* while allowing real wages to rise (2),

* and a reduction in working hours (3).

III. 1966-1982

The rate of surplus-value falls throughout this period because the slowdown in productivity gains (5) is no longer sufficient to compensate for the reduction in working time (3) and the continued rise in real wages limited to 1966-1972 (2).

IV. 1982-2013

The rate of surplus value rises again after 1982 because productivity gains in the consumer goods sector have recovered - but not to the levels of the immediate post-war period - (5), while working time is no longer falling (3), and the rise in real wages has slowed considerably (2) as a result of neo-liberal austerity. This rise in the rate of surplus value, together with the decline in the organic composition of capital until 2000, is the reason for the rise in the rate of profit until 1997 and its subsequent more moderate increase, as can be seen in the graph ‘Rate of profit - Rate of surplus value - Composition of capital, United States, 1929-2024’ above.

V. 2013...

The rate of capital gains has fallen slightly since 2013. It fell during the pandemic following measures to support economic activity. The challenge for the post-Covid employers' offensive is to get it back on track. The fight against inflation is an ideal pretext - as it was in the early 1980s - for justifying the rigour of neoliberal policy. As a result, the rate of capital gains has risen sharply between 2020 and 2023.

__________________________________________________________________

BRIEF EXPLANATION OF THE VARIABLES :

The rate of surplus value

The total value created is broken down into wages (value of labour power) and profits (surplus value). The rate of surplus value is the ratio of surplus value to wages. As surplus value is equal to the total value created minus wages, the rate of surplus value is equal to: surplus value / wages = (total value created - wages) / wages = (total value created / wages) - (wages / wages) = (total value created / wages) - 1 = (total value created / value of labour power) - 1 = [ (3) / (4) ] - 1 on the graph.

In other words, visually, the rate of surplus value increases as curves (3) and (4) move apart, and decreases as these curves move closer together.

It can also be shown that the rate of surplus value depends on the respective evolution of labour productivity and real wages: if labour productivity increases faster than real wages, then the rate of surplus value increases, and vice versa (for constant working hours). This is also shown in the graph: when the curve (5), which represents the inverse of productivity, falls faster than real wages (2) rise, then the rate of capital gain rises, and vice versa.

Real wages

This corresponds to the number of means of consumption (goods and services) that a worker can buy for himself. It is calculated by dividing the change in nominal wages by the change in consumer prices, in index form.

Value per means of consumption

This is the inverse of labour productivity. It is calculated by dividing the change in consumer prices by the change in the monetary equivalent of values (see below).

The monetary equivalent of values

In order to express our variables in terms of values in the Marxist sense (i.e. hours of work), we have divided the monetary quantities by the monetary expression of values, i.e. the quantity in dollars of one hour of value created. This is calculated by dividing the net domestic product of the market sector by the total number of hours worked in this sector.

.

Top of pageOrganic Composition of Capital and its Determinants, United States 1929-2024

![[Gb] - EU 1929-2024 - Composition organique du capital et ses déterminants](/telechargements/images/large_[Gb]_EU_1929_2024_Composition_organique_du_capital_et_ses_déterminants.png)

It is often argued that the fall in the rate of profit is the result of the increasing mechanisation of the economy: the growing use of the means of production would increase the organic composition of capital (the ratio in value between machines and labour). This is correct insofar as the counter-tendency underlined by Marx (i.e. productivity gains) is no longer capable of counteracting this growing mechanisation of the economy. Gains in productivity reduce the value of these means of production and thus compensate for the increase in their number [1]. This is exactly what the graph above shows: the organic composition of capital only increases when productivity gains in the means of production sector slow down and are no longer able to compensate for the increase in the technical composition of capital (the number of means of production per employee).

In stages (1929-44; 1958-69; 1983-2000; 2011-19), this technical composition only increases: over the whole period, an employee uses on average six times more means of production today than at the time of the Great Depression of 1929. Since variations in the decline in the value of labour power play little part in explaining fluctuations in the organic composition of capital, it is above all inflections in the productivity gains of the means of production that cause the value of the latter to fall and explain fluctuations in the organic composition of capital: when the value per means of production falls more rapidly than the increase in the technical composition of capital, then the organic composition falls, and vice versa.

_______________________________________________________

[1] « In short, the development which increases the mass of constant capital in relation to variable capital reduces, as a result of the increased productivity of labour, the value of its elements; it therefore prevents the value of constant capital, while constantly increasing, from increasing in the same proportion as the material mass, that is, the volume of the means of production set in motion by the same quantity of labour power. It may even be that, in certain cases, the mass of the elements of constant capital increases, although its value remains constant or even decreases » Marx, Le Capital, livre III, La Pléiade II : 1019.

« The rate of profit might even increase if the increase in the rate of surplus-value were connected with a marked diminution in the value of the elements of constant capital, particularly of fixed capital [as a result of the gains in productivity] » Marx, Le Capital, livre III, La Pléiade II : 1013

_______________________________________________________

BRIEF EXPLANATION OF THE VARIABLES :

The organic composition of capital

The organic composition of capital reduces constant capital to variable capital. It is the ratio between what merely transmits its value and what creates new value, or between what does not produce surplus-value and what does, or between past labour crystallised in the means of production and present labour provided by wage-earners. It is therefore calculated by dividing the fixed capital invested in production by the wage bill employed.

The technical composition of capital

Strictly speaking, the technical composition of capital is the number of means of production used per worker, or capital per capita. Its evolution allows us to measure the growth in volume of the means of production used per worker. This technical composition is calculated here by dividing the index of changes in the net capital stock (in $) by the index of changes in the prices of the means of production (in $ per means of production). The result of this ratio gives us an index of the increase in the number of means of production per employee.

Unit value of means of production

This is the inverse of productivity in the inputs sector. It is the evolution in index form of the average number of hours required to produce a means of production. This value is obtained by dividing the index of the average price of fixed capital by the monetary equivalent of the values (the equivalent in dollars of one hour of value created: it is calculated by relating the net domestic product of the market sector to the total number of hours worked in this sector).

.

Top of pageReal Wages and Productivity, United States 1948-2021

![[USA] - EU 1948-2021 - Salaires réels et Productivité](/telechargements/images/large_[USA]_EU_1948_2021_Salaires_réels_et_Productivité.png)

The postwar period is characterized by a parallel increase in productivity and real wages. This stabilizes the share of wages in total output and enables capitalism to avoid, for some time, « Over-production [which] arises precisely from the fact that the mass of the people can never consume more than the average quantity of necessaries, that their consumption therefore does not grow correspondingly with the productivity of labour » (Marx [1]).

Such is the basic explanation adopted by postwar Marxists to account for that period’s prosperity : « It is undeniable that wages have risen in the modern epoch. But only in the framework of the expansion of capital, which presupposes that the relationship of wages to profits should remain constant in general. Labour productivity should therefore rise with a rapidity which would make it possible both to accumulate capital and to raise the workers' living standards » (Mattick [2]). In other words, « both wages and profits can rise if productivity grows sufficiently » (Mattick [3]). This shows us that the regulation school has not invented anything basically novel : it has simply extended an analysis already well developed by Marx and his followers (Marx [4]).

The lag between productivity and wages will only become apparent and increasing from the 1980’s onwards. The more rapid increase in productivity (upper curve) than in wages (lower curve) materializes capitalism’s natural tendency to expand production to a larger extent than solvent demand. This is nothing else than the basic explanation of overproduction put forward by Marx : « Over-production is specifically conditioned by the general law of the production of capital : to produce to the limit set by the productive forces, that is to say, to exploit the maximum amount of labour with the given amount of capital, without any consideration for the actual limits of the market or the needs backed by the ability to pay…» [5]. In other words : « The ultimate reason for all real crises always remains the poverty and restricted consumption of the masses as opposed to the drive of capitalist production to develop the productive forces as though only the absolute consuming power of society constituted their limit… » [6].This is also what Engels summarized in a formula typically of his own : «While the productive power increases in a geometric ratio, the extension of markets proceeds at best in an arithmetic ratio » [7].

__________________

[1] Marx, Theories of surplus value (1861). Chapter XVI : Ricardo’s Theory of Profit, 3) Law of the Diminishing Rate of Profit, e) Ricardo’s Explanation for the Fall in the Rate of Profit and Its Connection with His Theory of Rent.

http://www.marxists.org/archive/marx/works/1863/theories-surplus-value/ch16.htm.

[2] Paul Mattick, Intégration capitaliste et rupture ouvrière, EDI, p151 (our translation).

[3] Paul Mattick, Le capital aujourd’hui, published by Maximilien Rubel in Etudes de marxologie, n°11, juin 1967 (our translation).

[4] Especially by 'Socialisme ou Barbarie' (1949-67), a French Marxist journal well-known at that time. The latter has largely inspired the regulation school (Aglietta, Souyri, Lipietz,…), as can be seen from this long quotation (we translate) : « Capitalism can make a compromise concerning the distribution of the social product, precisely because wages that increase more or less at the same rate as labour productivity leave the existing distribution practically unaltered. (…) The classical idea was that capitalism could not bear wage increases, for the latter would imply decreasing profits, hence a reduction of the accumulation fund that any firm badly needs to survive competition. But this static picture is not realistic. If workers’ productivity increases by 4%, with wages increasing at the same rate, profits also must increase by 4%, all other things being equal. (…) As long as wage increases are generalized and do not substantially exceed productivity gains, they are perfectly compatible with the expansion of capital. They are even indispensable from a purely economic viewpoint. In an economy that grows at an average yearly rate of 3%, and in which wages amount to 50% of final demand, any somewhat substantial gap between the rate of increase of wages and the rate of expansion of production would fairly rapidly lead to formidable imbalances and to an inability to sell off production, which could not be remedied by any ‘depression’, deep though it might be » (Socialisme ou Barbarie, n° 31, article written in 1959 and published in 1960.)

[5] Marx, Theories of Surplus Value, Ch. XVII.

[6] Marx, Capital, Vol 3, Chapter 30 : "Money capital and real capital: 1", p 615.

[7] F. Engels, Preface to the English edition of Volume I of Capital (1886).

The methodological framework of Marx’s theory of crises and its empirical validation

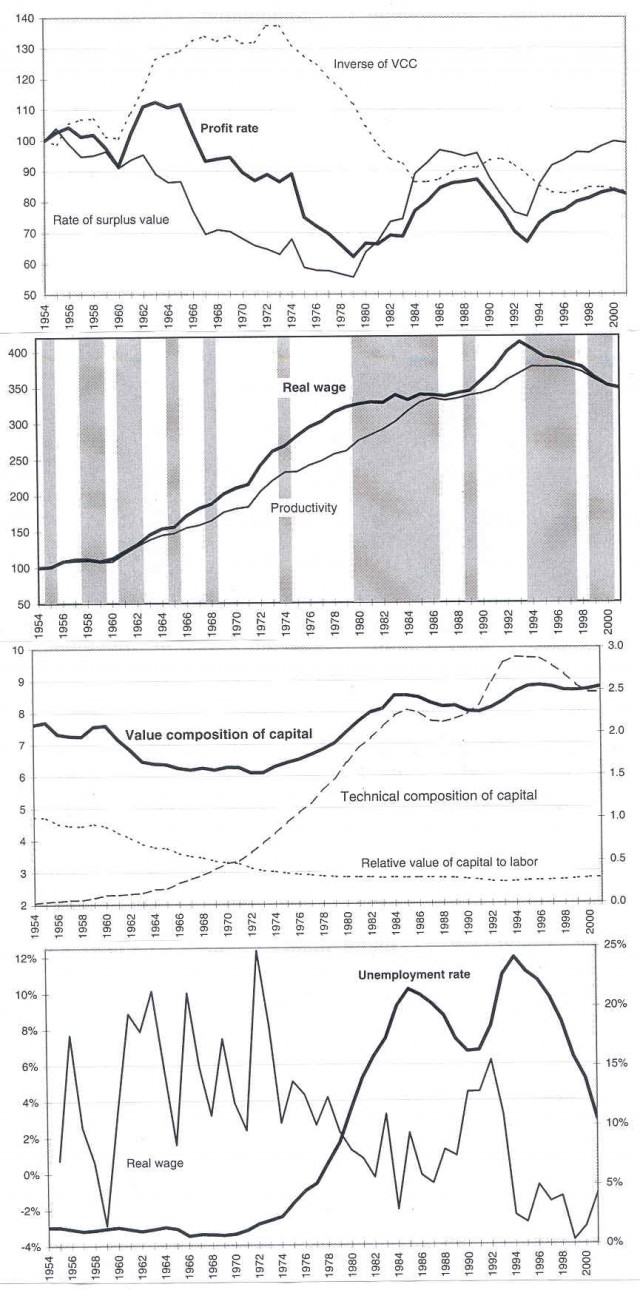

The three phases after World War II and their determinants [1]

1) From the end of the war up to 1965, the profit rate remains at a high level (figure 1) due to labour productivity gains (figure 2), which tend to reduce the value organic composition of capital (figure 3, as well as figure 1 for the inverse of this composition). This reduction in the composition of capital is sufficient to compensate the reduction in the rate of surplus value (figure 1). The latter is due to the fact that real wage increase more than labour productivity (figure 2 [2]).

2) From 1965 to 1979, the profit rate continuously goes down due to the decline in the rate of surplus value (figure 1). This decline in the rate of surplus value is first coupled with a stable composition of capital (1963-73), then with a rising composition (1973-84) (figures 3 and 1). Firms compensate this decline in the profit rate through massive cuts in employment (figure 4). The growing industrial reserve army during the seventies results in a slowing down of the rate of increase of real wage (figures 2 and 4).

3) From 1979 to 2001, this slowing down of the rate of increase of real wage, compared to the rate of increase of labour productivity, results in a remarkable recovery of the rate of surplus value and, consequently, of the profit rate, but not so much of economic growth. The latter will be mainly stimulated by indebtedness of an Anglo-Saxon type as we know it today.

... More will be found in our article : "The methodological framework of Marx’s theory of crises and its empirical validation" ... unfortunately only in french : « Le cadre méthodologique de la théorie des crises chez Marx et sa validation empirique ».

________________________________

[1] These four figures appear in an excellent article by Sergio Camara Izquierdo : "The Dynamics of The Profit Rate in Spain (1954-2001)". The latter is available on-line : http://rrp.sagepub.com/cgi/content/abstract/39/4/543.

[2] The shadowed areas of figure 2 refer to periods during which real wage rise less than labour productivity. The year 1979 shows a marked change : during the preceding period, real wage generally rise more than labour productivity, and conversely thereafter.

.

Top of page